Surety Bonds Explained

If your business regularly tenders for projects, you’ll know that providing security to demonstrate you can meet your contractual obligations is essential. Traditionally, this has meant tying up cash or property to secure a bank guarantee — locking away valuable resources that could otherwise fuel growth.

But there’s another option: surety bonds.

Surety bonds provide the same unconditional, on-demand guarantee as a bank guarantee, but without requiring cash collateral or property security. That means you can free up working capital, reduce debt, and confidently tender for larger projects. For businesses with ambitious growth plans, and subject to qualifying criteria, surety bonds can be a powerful strategic tool.

However, surety bonds are not a one-size-fits-all solution. Understanding eligibility requirements, facility structures, and insurer expectations is key to determining whether they’re the right fit for your business.

Let’s explore how surety bonds compare to bank guarantees, how they work in practice, and the main considerations for assessing alignment with your financial and operational goals.

What is a Surety Bond?

Certain industries, such as Construction and Engineering, are required to provide cash retentions (i.e., the beneficiary retains a specified percentage of payments until the works are completed) and/or bank guarantees to cover the performance and warranty aspects of the contract work. However, since the bank usually demands dollar-for-dollar cash security to back the bank guarantee facility, this can deplete cash flow from the business, as can cash retentions.

A surety bond is an ‘unconditional’ guarantee that acts as an alternative to cash or a bank guarantee, providing assurance that a business will fulfil its contractual obligations.

Unlike traditional bank guarantees, surety bonds are not required to be secured by property and/or cash and issued by insurers, meaning they do not generally require cash or tangible assets as collateral.

A surety is not an insurance policy. The payment made to a surety firm pays for the bond, but the principal remains responsible for the debt.

This structure offers businesses greater financial flexibility and improved cash flow by freeing up valuable resources, allowing them to preserve their assets and allocate resources more effectively. It can also enable new growth opportunities and gives businesses the confidence to pursue larger projects or expand their operations without the constraint of locked-up capital.

How Do Surety Bonds Work?

Surety bonds are a form of guarantee issued by a surety, rather than a bank.

There are three parties to a surety bond:

1. The surety (as guarantor).

2. The obligee is the party required to perform the subject matter of the bond, i.e., the contractor or service provider.

3. The party in whose favour the bond is issued and who has typically requested the guarantee to be provided, i.e. the beneficiary.

If the contractor fails to perform the obligations for which it was required to provide a bond or guarantee, the beneficiary of the bond can present the bond to the surety and receive up to the bond amount. Beneficiaries can include corporations, utilities, government authorities and councils.

This is how surety bonds work:

1. Securing the Bond:

- The principal purchases a surety bond to guarantee that they will complete the work / ‘Performance’ (usually amounting to 5 or 10% of the contract value), as coverage for a ‘Defects Warranty’ bond upon practical completion (commonly 5 or 2.5% of the contract value, over 12 months after the completion of works).

- The bond is issued by a surety (often an insurance company, bank, or specialised bond company).

- The premium (the cost of the bond) is usually a percentage of the bond value and is determined by factors such as the principal’s financial position and the size of the contract.

2. Fulfilling the Obligation:

- Once the bond is in place, the principal is legally obliged to comply with the terms of the contract.

- If the principal fails to meet the contractual obligations or defaults in any way, the obligee has the right to make a claim against the bond.

3. Making a Claim:

- The obligee files a claim with the surety.

- The surety is then obliged to pay the value of the bond to the beneficiary within a certain legal period (e.g. 48 hours). For example, if a contractor fails to complete the work specified in a construction contract, the obligee (project owner) can claim the bond to cover the costs of hiring another contractor to complete the project.

4. Recovering the Claim:

- After paying the claim to the obligee, the surety will usually seek to recover the amount paid, along with any associated fees and interest, from the principal.

- This is because the surety is essentially stepping in to protect the obligee from financial loss, but it is the principal who is ultimately responsible.

5. Bond Amount:

- The bond amount (usually the maximum liability) is specified in the contract and can vary significantly.

What is the Difference Between a Surety Bond and a Bank Guarantee?

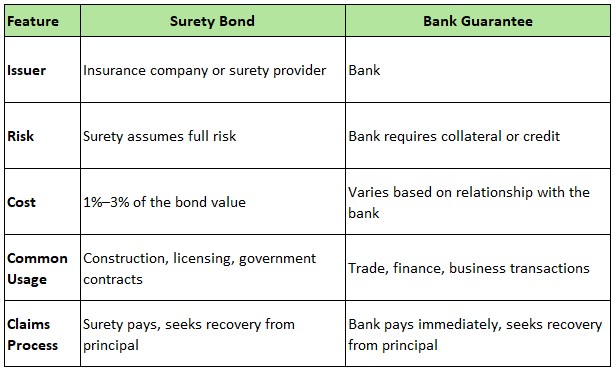

Both surety bonds and bank guarantees are unconditional, on-demand guarantees issued by an S&P (Standard & Poor) rated financial institution, to ensure obligations are met.

However, they differ significantly in terms of the issuing party, the level of risk taken on, and the way in which claims are handled.

Surety bonds tend to offer more comprehensive protection because the surety assumes a greater responsibility for the principal’s actions, while bank guarantees are more straightforward, with the bank acting as a facilitator and requiring less financial risk.

Such differences can help businesses determine which option is most suitable depending on the nature of their obligations, their financial relationships, and the level of risk involved.

Issuer:

- Surety bond: Issued by an insurance company or specialised surety provider.

- Bank guarantee: Issued by a bank.

Risk:

- Surety bond: The surety assumes full responsibility for the principal’s obligations and will then seek reimbursement from the principal if a claim is made.

- Bank guarantee: The bank usually requires collateral or a credit relationship with the principal to reduce its exposure.

Cost:

- Surety bond: Usually 1 – 3% of the bond’s value, depending on the principal’s credit rating. (Typically a higher rate than bank guarantees due to the lower level of security held in support).

- Bank guarantee: Fees depend on the borrower’s supporting security, ratings etc.

Claims Process:

- Surety bond: The obligee claims against the surety, which then seeks repayment from the principal.

- Bank guarantee: The obligee claims directly from the bank, which pays immediately and then seeks repayment from the principal.

Usage:

- Surety bond: Common in (but not limited to) construction, licensing, and government contracts.

- Bank guarantee: Used in (but not limited to) trade, finance, and business transactions.

Why Use Surety Bonds?

There are several benefits to using surety bonds:

- No collateral required: Unlike banks, surety providers do not require security over assets or cash collateral.

- Freed-up capital: This allows businesses to free up funds that would otherwise be tied up, which improves cash flow.

- Reduced debt: By freeing up capital, businesses can reduce their debt levels, thus improving their overall financial health.

- More contract opportunities: With greater financial capacity, businesses can tender for additional contracts and take on larger projects.

- Cost-effective alternative: Surety bonds can often prove a cheaper option than bank guarantees, with no line fees or overhead costs associated with securing the bond.However, it’s important to assess your specific needs, financial situation, and long-term goals to determine the most appropriate financial solution for your business.

What are the Key Considerations for a Suitable Facility?

There are several factors to consider when choosing a surety bond facility:

- Facility size and rate: The facility should suit the specific needs of your business. The rate is determined by factors such as the facility size (i.e. the bond value) and your risk profile and financial history. Ensure the facility supports your operations without being too restrictive or expensive.

- Issue fees: These are the initial fees charged when securing the facility. They can vary based on the bond size and complexity. Be sure to understand these fees, as they can impact your upfront cash flow.

- Renewal fees: Many facilities require annual renewals, which can become an ongoing cost. It’s important to understand how these fees are structured and whether they change according to the bond value, business performance, or provider policies.

- Acceptability: This refers to how widely recognised and trusted the facility is by clients, government bodies, or contractors. Ensure the provider’s bonds are accepted in the industries or projects you’re targeting.

- Access to bank fronting: Some sureties require bank fronting for higher bond amounts or if your financial standing is under review. Be sure to understand the terms of fronting, as this could affect your liquidity.

What are the Key Considerations from an Insurer’s Perspective?

There are several financial and operational factors an insurer must carefully evaluate to determine the risk and suitability of providing a surety bond to a business:

- Balance sheet size: Insurers typically look for businesses with a minimum net equity of $3M or more, as this indicates financial stability and the capacity to fulfil obligations.

- Minimum turnover: A turnover of at least $30M, with a clear upward trajectory, demonstrates the growth potential of a business and its ability to manage larger contracts and guarantees.

- Past history of guarantee issues: Insurers will assess whether the business has a clean record regarding past claims or defaults. A proven history of successfully meeting guarantee obligations will boost your credibility.

- Frequency and value of guarantees: The number and size of guarantees issued reflect the business’s experience and reliability. Insurers will look at both the volume of guarantees and the risk associated with each one.

What are Bank-Fronted Surety Bonds?

Bank-fronted surety bonds provide clients with the financial flexibility that surety affords, even in situations where a beneficiary will only accept a bank guarantee:

- Fronting arrangements: If a beneficiary doesn’t accept surety bonds directly, the underwriter can arrange for the bond to be fronted by a bank.

- Simple documentation: The insurer’s term sheet and indemnity documentation include a straightforward clause to allow for fronting transactions.

- Bank collaboration: The insurer has its’ own arrangement with a major bank, allowing them to issue a bank guarantee to the client at the insurer’s request.

- Cost structure: For a fronting transaction, the insurer will charge the ‘standard’ facility base rate, plus an additional fronting fee to cover the bank’s costs.

What are the Common Types of Surety Bonds in Australia?

Some of the most common types of surety bonds in Australia include:

- Performance bond: Guarantees the contractor will complete the project in accordance with the agreed terms.

- Payment bond: Ensures that subcontractors and suppliers will be paid for their work and materials.

- Tender bond: Provides assurance that a contractor will honour their bid if awarded the contract.

- Retention bond: Replaces the need for retention money to be held by the client, improving cash flow for contractors, while ensuring project completion.

- Advance payment bond: Protects the employer if advanced payments made to the contractor are not used for the intended purpose.

- Maintenance bond: Ensures defects or incomplete work are corrected during the maintenance period following the completion of a project.

- Licence and permit bond: A requirement for businesses to obtain certain licences or permits, ensuring compliance with industry standards.

- Customs bond: Guarantees compliance with customs regulations for businesses involved in importing and exporting goods.

Are Surety Bonds Right for Your Business?

Surety bonds provide a flexible, cost-effective alternative to traditional bank guarantees, offering businesses the ability to secure large contracts without tying up valuable assets or cash collateral.

However, it’s important to conduct thorough due diligence to determine if a surety bond is suitable for your business and meets qualifying requirements. This involves reviewing your financial health and carefully evaluating the bond requirements and the credibility of the surety provider.

Ledge Finance, a leading commercial finance broker in Australia, can facilitate a range of finance solutions to support your business goals. Get in touch to learn more.