- Whilst the RBA Cash rate is a market indicator, banks are not sourcing their funds from the RBA at this rate.

- The bank’s cost of funds is a complex situation unique to each of their respective positions, and the pricing of the various types of finance facilities they offer, be them fixed or variable, is not directly linked to the RBA Cash Rate.

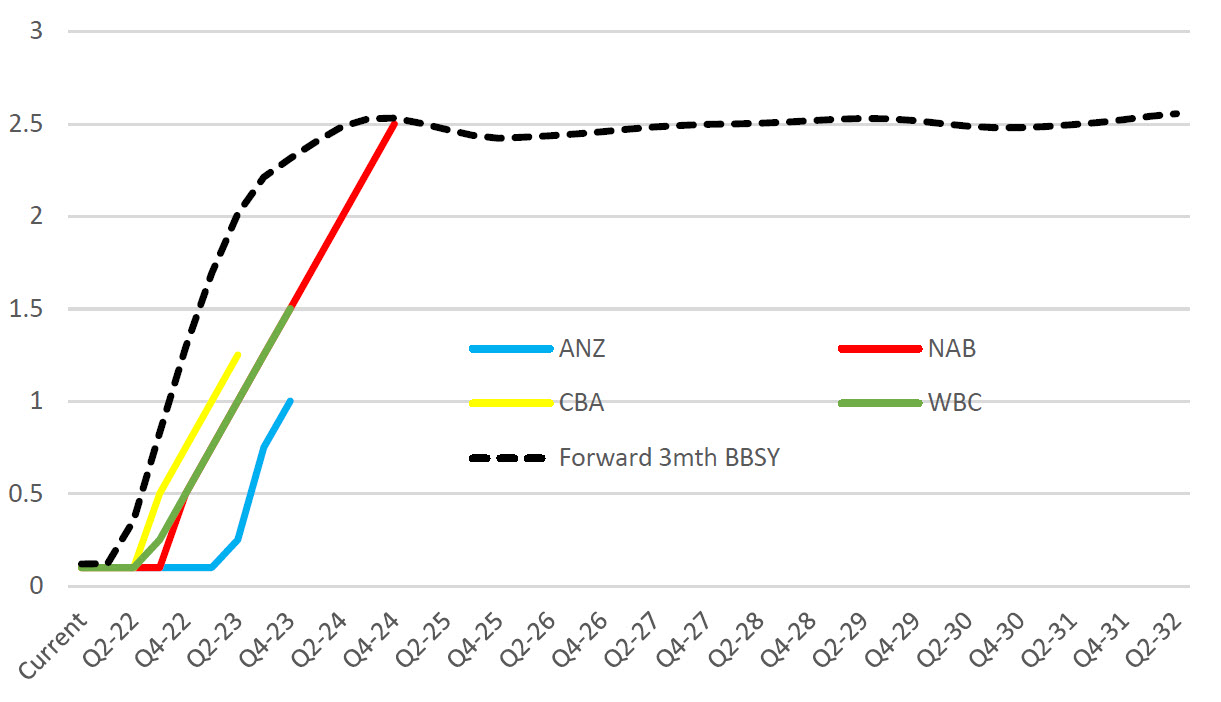

- Despite the RBA keeping the cash rate on hold, the banks are already factoring in increased cost of funds which is reflected in their pricing of fixed rate facilities such as equipment finance.

- Whilst the variable rates remain relatively stable for now they are expected to move upwards in the near future. There is typically a lag with variable rates compared to fixed, which are much more volatile and reflective of wholesale cost of funds and bank forecasts.

Major Bank’s Cash Rate Forecast

Source: NAB

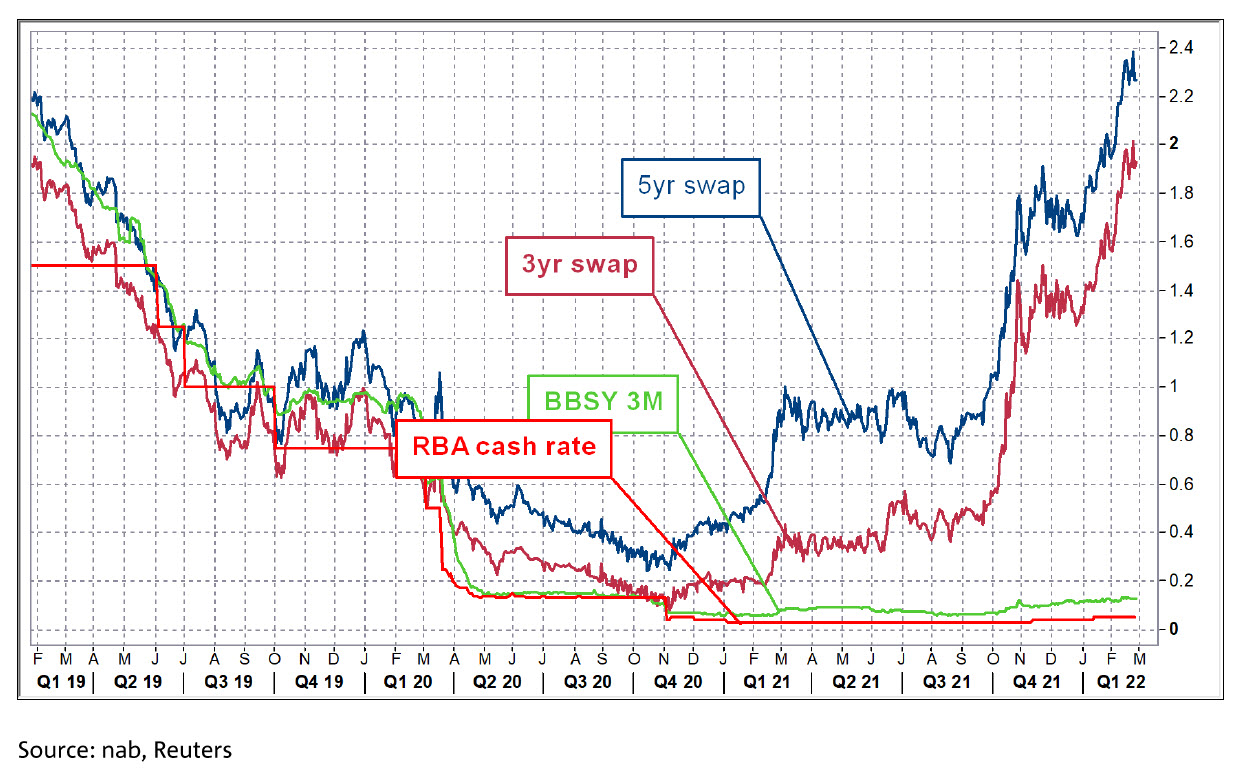

- In 2019, the RBA Cash Rate and corresponding fixed rates from the banks, began to drop, as we faced into the pandemic and the economic impacts began to be felt.

- From late 2020 and throughout 2021 longer term fixed rates began to rise as successful vaccination trials were announced and vaccination rollouts gathered momentum.

- This trend has continued into 2022, with fixed rates moving upwards another 60 points in the first two months.

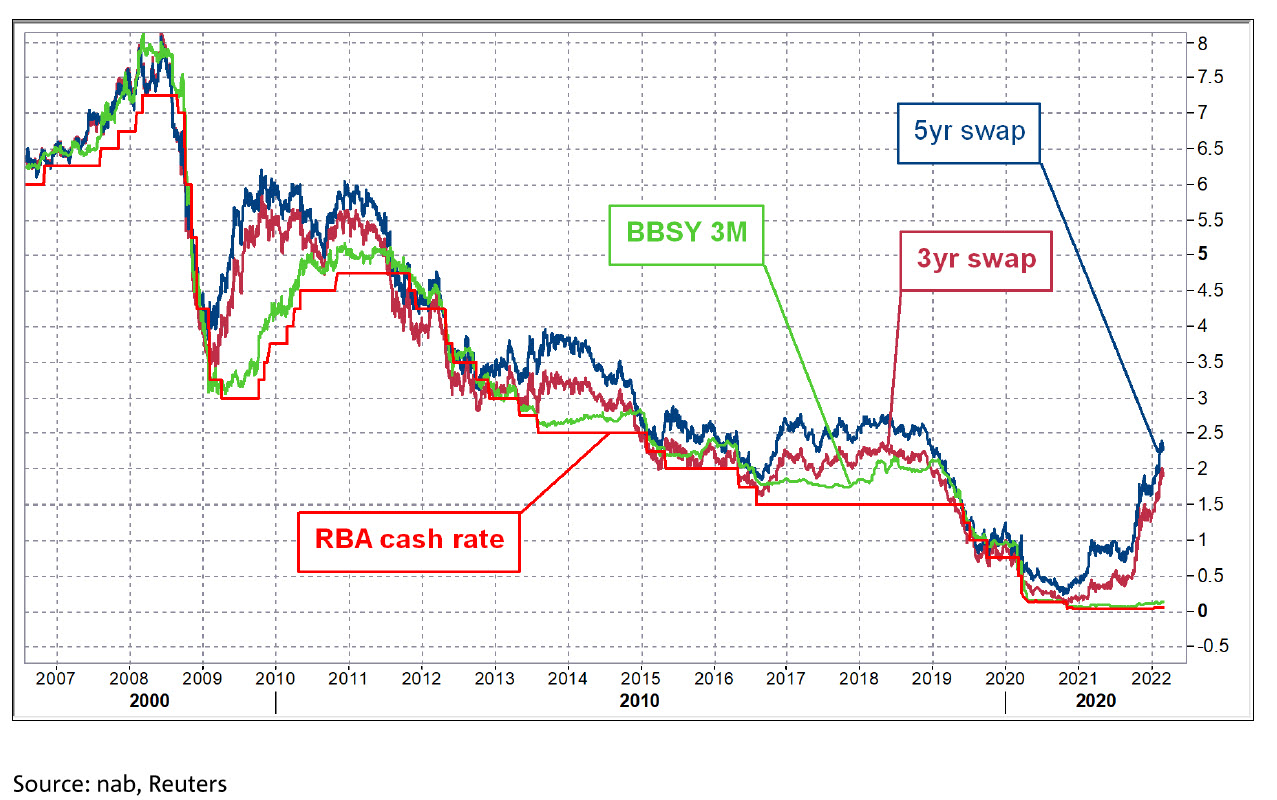

Current market rates in perspective

Despite recent increases in the 3 and 5 year swap rates, when looking at the historical data, these rates are now just getting back to pre-covid years and historically are still low.

Want to know more?

To find out more, speak to your Ledge Finance Executive directly or contact our offices on (08) 6318 2777.