Most business owners would agree that it can be quite stressful when trying to remember key dates throughout the year. For this reason, we have prepared a list for you to refer back to for 2022, including bas due dates, bas lodgement dates and PAYG instalments just to name a few:

January 2022

15 January:

- Lodge tax return for the taxable head company of a consolidated group (including a new registrant) that has a member deemed a large/medium entity in the latest year lodged.

- Lodge tax return for taxable large/medium taxpayer’s entities as per the latest year lodged.

21 January:

- Lodge and pay quarterly PAYG IAS (Oct – Dec 2021) for head companies of consolidated groups

- Lodge and pay December 2021 monthly business activity statement except for business clients with up to $10 million turnover who report GST monthly and lodge electronically.

28 January:

- Quarterly SGC statement due (Oct – Dec 2021)

31 January:

- Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in quarter 2, 2021-2022

February 2022

21 February:

- Lodge and pay January monthly BAS

- December monthly BAS for business clients with up to $10 million turnover who report GST monthly and lodge electronically

28 February:

- Tax return for non-taxable large/medium entities as per the latest year lodged

- Tax returns for new registrant (taxable and non-taxable) large/medium entities

- Tax return for non-taxable head company of a Consolidated group, including a new registrant

- Tax return for any member of a consolidated group who exits the consolidated group for any period during the year of income

- Tax return for large/medium new registrant (non-taxable) Consolidated group

- SMSF Fund Annual Return for new registrant (taxable and non-taxable) SMSF, unless they have been advised of a 31 October 2021 due date at finalisation of a review of the SMSF at registration

- Lodge and pay quarter 2, 2021-22 activity statement for all lodgement methods

- Quarterly Instalment Notice (form R, S or T) (Oct – Dec 2021)

- Annual GST return – lodge (and pay if applicable) if the taxpayer does not have a tax return lodgment obligation

- SG charge statement – quarterly (Oct – Dec 2021) if the employer did not pay enough contributions on time

March 2022

21 March:

- Lodge and pay February monthly BAS

31 March:

- Lodge tax return for companies and super funds with total income of more than $2 million in the latest year lodged (excluding large/medium taxpayers), unless the return was due earlier

- Lodge tax return for the head company of a consolidated group (excluding large/medium), with a member who had a total income in excess of $2 million in their latest year lodged, unless the return was due earlier

- Lodge tax return for Individuals and trusts – latest return resulted in a tax liability of $20,000 or more, excluding large/medium trusts

April 2022

21 April:

- Quarterly PAYG IAS (Jan – Mar 2022) for head companies of a consolidated group

- Lodge and pay March monthly BAS

28 April:

- Lodge and pay quarter 3, 2021-22 activity statement if electing to receive and lodge by paper and not an active STP reporter.

- Pay quarterly Instalment Notice (form R, S, or T) (Jan – Mar 2022)

- Quarterly SG Contributions (Jan – Mar 2022)

30 April:

- Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in quarter 3, 2021-22.

- Lodge lost members report for the period 1 July 2021 to 31 December 2021.

May 2022

15 May:

- 2021 Tax Returns for all entities that did not have to lodge earlier and are not eligible for the 5 June concession.

21 May:

- Lodge and pay April monthly BAS

- Final date to add new FBT clients to your client list to ensure they receive the lodgment and payment concessions for their fringe benefits tax returns.

- Lodge and pay FBT annual return if lodging by paper

26 May:

- Lodge and pay eligible quarter 3, 2021-22 activity statements if you or your client have elected to receive and lodge electronically.

28 May:

- SG charge statement – quarterly (Jan – Mar 2022) if the employer did not pay enough contributions on time.

June 2022

05 June:

- Lodge tax return for all entities with a lodgment due date of 15 May 2022 if the tax return is not required earlier.

- Lodge tax returns for individuals and trusts with a lodgment due date of 15 May 2022

21 June:

- Lodge and pay May monthly BAS

25 June:

- Lodge and pay 2022 Fringe benefits tax annual return for tax agents if lodging electronically.

30 June:

- SG contributions must be paid by this date to qualify for a tax deduction in the 2021-22 financial year.

- END OF 2022 FINANCIAL YEAR

Please Note: This is only a concise list, as such there may be other key dates that relate to your business. For more information please refer to the below websites or speak to your accountant for more.

Australian Government Business

2020 – 21 Business Incentive Summary – Plant & Equipment

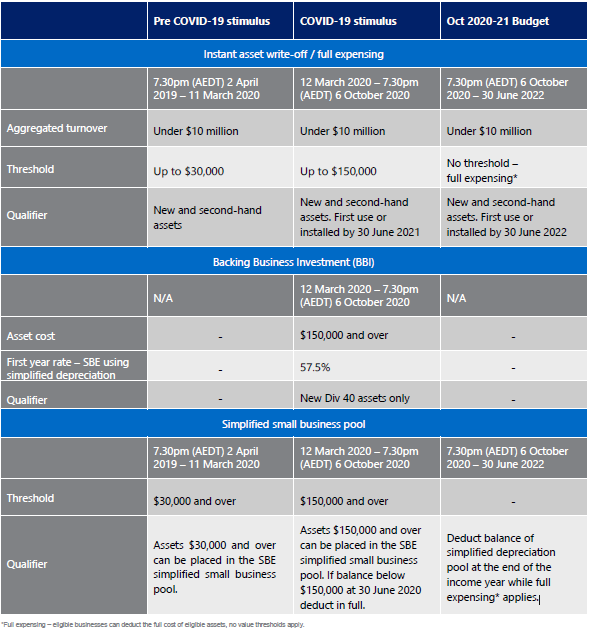

Small Business Entities

2020 – 21 Business Incentive Summary – Plant & Equipment

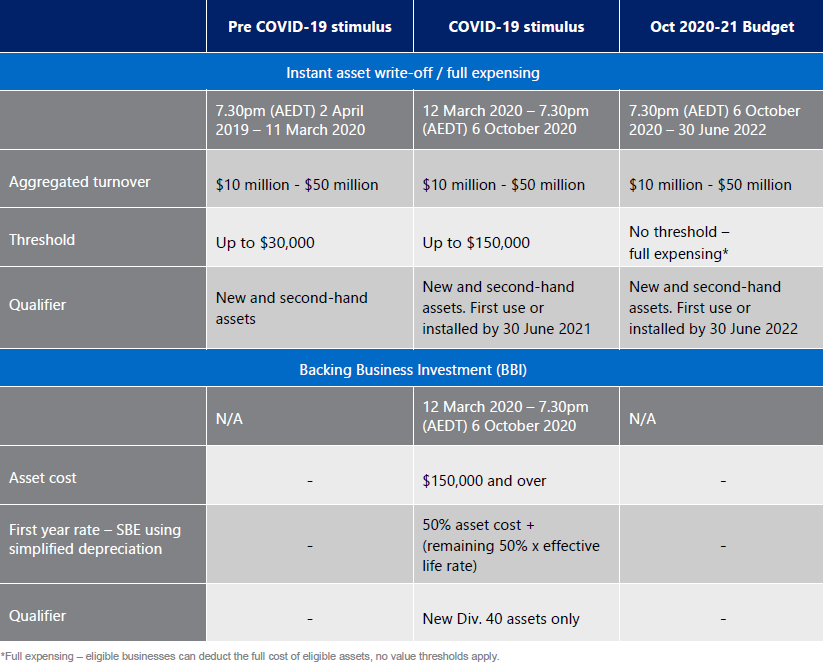

Medium Business Entities

2020 – 21 Business Incentive Summary – Plant & Equipment

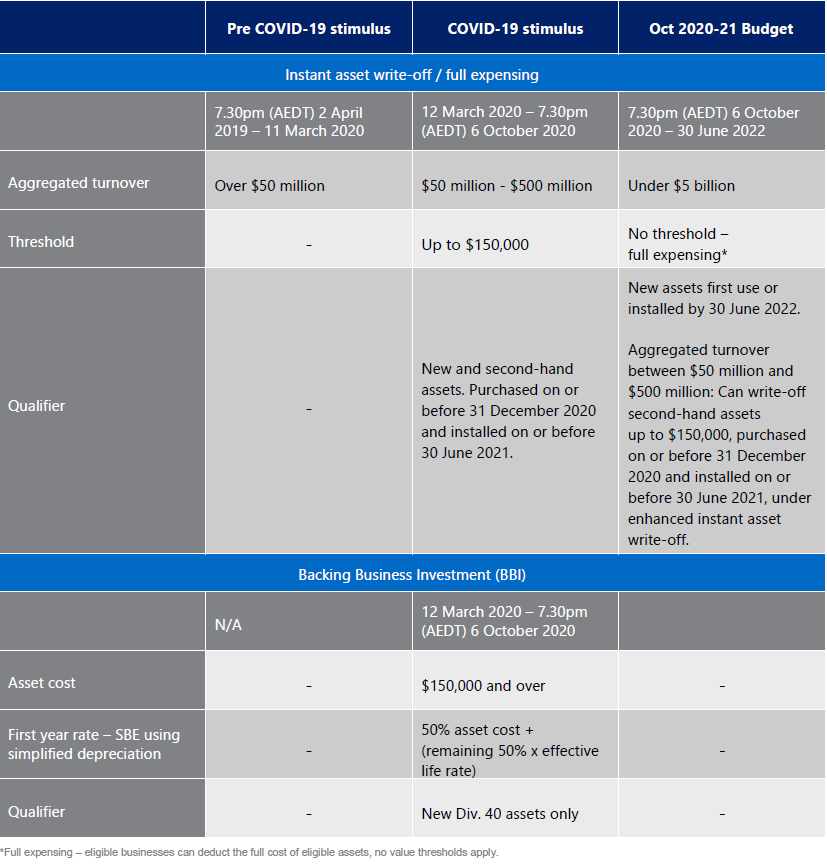

Large Business Entities

Tax terms explained

BAS

What is a BAS?

BAS, or business activity statement, is required if you are a GST-registered business. It is a way of letting the government know how much was paid on purchases and for the ATO to work out your GST refund or bill.

What are BAS Due Dates?

BAS is completed one to twelve times a year depending on the size of your business. If your business has a $20 million annual turnover, BAS is due between the 21st – 23rd day of the month following the end of the taxable period. For example, June monthly BAS is due on 21 July. If your business has less than a $20 million turnover, it will have to be completed quarterly. And if you turnover less than $75,000 (or $150,000 for non-profits) you lodge a BAS annually.

Super Guarantee Charge (SGC)

What is an SGC?

Employers are required to pay their employees a superannuation guarantee which is outlined in the employment conditions. A Super Guarantee Charge (SGC) is what an employer may have to pay to the ATO if they fail to pay the super guarantee to the correct super fund by the due date.

When is SGC Due?

The employer must lodge the SGC statement and pay the charge to the ATO by the 28th day of the second month after the quarter. For example, for quarter 1 (July – September) the SGC statement and SGC itself is due on 28 November.

PAYG Instalment and Withholding

What is a PAYG Instalment?

PAYG, or pay as you go, is where you pay your income tax in instalments, helping you to avoid a large tax bill after you lodge your business’ income tax return.

What is PAYG withholding?

PAYG withholding is the amount of tax you withhold from their pay which then gets sent to the ATO. Employees can then claim against the amount withheld at the end of the financial year.

Business Incentive Summary – Plant & Equipment

Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use.

Instant asset write-off can be used for:

- multiple assets, if the cost of each individual asset is less than the relevant threshold

- new and second-hand assets.

If you are a small business, you will need to apply the simplified depreciation rules in order to claim the instant asset write-off. It cannot be used for assets that are excluded from those rules.

The instant asset write-off eligibility criteria and threshold have changed over time. You need to check your business’s eligibility and apply the correct threshold amount depending on when the asset was purchased, first used or installed ready for use.